We have now been made aware of two cottage owners who have sadly fallen prey to a very costly Vishing Scam. After doing a little digging around online, it appears this type of scam has been in operation for some while, and it looks like the holiday rental market is being targeted. This type of scammer uses scare mongering techniques to panic owners into parting with money, so please be warned and spread the word to other holiday home owners. The more people that are made aware, the less that will get caught.

In the cases reported to us, the owners financial loss was huge, one loosing just short of £2000 (£1998.65 to be exact) and the other £3900 – a devastating amount of money to loose from your rental income.

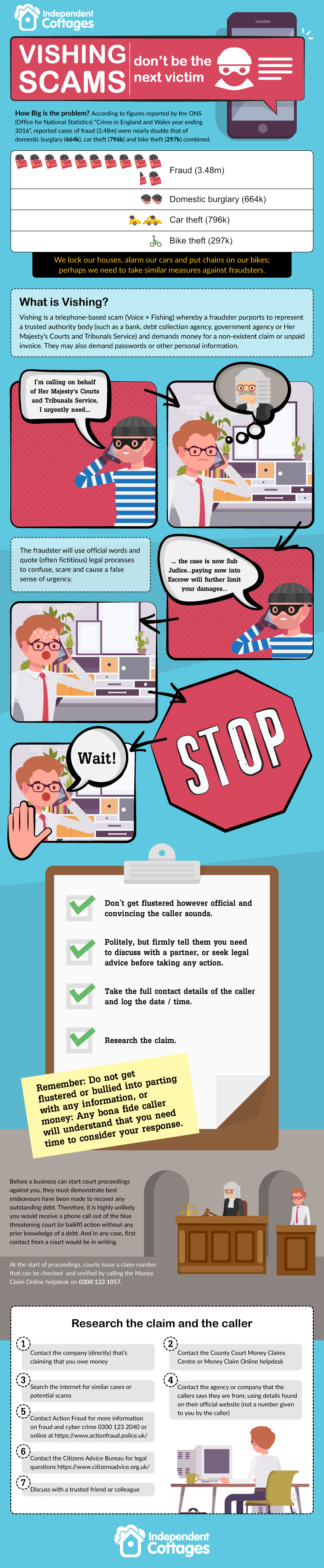

What is a vishing scam?

Vishing is a fraudulent technique used via telephone by somebody purporting to be a member of a trusted authority figure (such as a bank, government agency, debt collecting agency or even Her Majesty’s Courts and Tribunals Service). It is a highly effective technique that preys on an individual’s vulnerability and trust for a familiar authoritative body. To find out more about phishing, vishing and smishing visit Action Fraud.

Key facts of this particular scam:

- Phone based scam.

- Contacted by a person who reports to be working as a High Court Officer or someone working for a debt collecting agency on behalf of a court – they will often quote the name of your local court making it appear more genuine.

- In both cases they claimed the owner was being prosecuted by an advertising agency for non-payment.

- Payment was requested in order to stop the escalation of prosecution/court proceedings.

Specific examples of vishing scams in the holiday rental market

Example of first reported fraud case

The first scammer phoned the cottage owner and introduced himself as Martin Sean Jones (a man of many names!), claiming he was a registered Bailiff Enforcement Officer (or High Court Enforcement Officer) who was working on behalf of Cardiff County Court Justice Centre (note that he quotes the local county court to add authenticity).

‘Mr Jones’ stated that he had a High Court writ in the owner’s name that was taken out by an advertising company (he quoted one that the owner felt was familiar). He was authoritative, firm and convincing and advised the owner to pay the court to stop the writ escalating. He claimed to be at the court with the writ in hand and confirmed that once payment had been made, the court would hold the payment for 14 days, whilst investigating the case. Funds would then be returned should the court deem fit. The caller also provided the owner with references for the case (including a reference to provide to bailiffs should they turn up at her door, as well as a court reference).

When Mr Jones was questioned about his identity, the owner was directed to an online Certified Bailiff Register. The website was an official .gov.uk website where Martin Sean Jones was listed under Cardiff Civil Justice Centre. It would appear that the caller had falsely taken Mr Jones identity. The owner also asked for a contact telephone number and was given 02920376400 which at first glance was familiar as a Cardiff number (later proving to be false), adding further authenticity to the situation.

The owner was convinced they did not owe any money. However, they were conscious that they had been listed on a number of different websites over the years so concerned something could have been overlooked. As Mr Jones credentials appeared to be legitimate, they made payment to stop the situation escalating. The owner was requested to make payment by bank transfer and was told that credit/debit cards could not be accepted by a court as you had to have means to pay. Mr Jones provided further reassurance at the point of payment by asking the owner not to reveal any bank details or quote any passwords out loud whilst making the online bank transfer. The transfer was made to an account of a well-know British bank and the account name was CCJC (abbreviated as apparently the whole justice title would not fit into the space).

The scammer told the owner that the payment would come out in two hours and they would receive an emailed receipt from the court. However, the payment came out immediately and the owner has since found out that they have been victims of a scam and the money cannot be recovered.

Unfortunately, for this owner, they were caught at a particularly vulnerable time when they were investigating an unrelated utilities issue, thus causing them to be easily scared and panicked into making a rash decision.

Example of second reported fraud case

Like the first case, this vishing scam bears many similarities but tragically, this owner lost just short of £4000 as the scammer was particularly greedy.

This time the person used the name Brian Jones and claimed he was a debt collector on behalf of an advertising agency (he quoted York Court and provided details of an official looking website where he was listed as an employee). The owner explained that she had not received any paperwork about the debt but was told that if this was the case, the agency was in breach of contract and any money paid would be returned. When the owner was told that money needed to be paid asap to prevent prosecution for non-payment, £1950 was paid via bank transfer.

On this occasion, the scammer was particularly ruthless and then phoned back ten minutes later claiming the money had not gone through and requested payment again from a different account, giving assurances that the first payment would be returned on receipt of the second. Because the owner was in such a state of shock having never been prosecuted for anything before, the second payment of £1950 was duly made via bank transfer. Both payments were, like the first case, made to accounts of well-known British banks.

Lessons Learnt: Avoid being the next victim

This has obviously been very distressing for the owners and a huge financial blow. Here are some things you can do to make sure you are not the next victim to be caught by this sort of vishing scam:

- If you receive a phone call out of the blue, do not be pressurised, panic and part with any money. Take full details from the caller (see below), hang up, do some research and make sure it is legitimate before even considering parting with any money.

- When outstanding debt comes as a total surprise to you, then there is every chance that it may not be genuine. In the event of you missing an invoice and having outstanding debt, a creditor (person who is owed money) would normally take a number of steps to communicate with you to resolve the issue before starting court proceedings. It is highly unlikely that you would be completely unaware of outstanding debt by the time a court got involved; and if a court did get involved you would be contacted formally in writing in the first instance. When court proceedings are instigated, a claim number is allocated and anyone contacting you (e.g. a bailiff) would have the claim number and be able to provide you with it as proof of authenticity. The County Court Money Centre are able to confirm that a claim number is genuine and are contactable on 0300 1231057.

- Gain the following details from the caller (if you can!): name of caller; who they are collecting on behalf of; contact phone number for the caller; bank details they are requesting payment into (sort code, account no. and bank name); amount of supposed outstanding money and any claim or warrant no. Also keep a log of all phone calls and conversations.

- Contact Action Fraud on 03001232040 who can assist and provide information on fraud and cyber crime.

- Contact the company they say they are collecting money on behalf of (using the contact number listed on the company’s website and not one given to you by the caller).

- If suspicions are ever raised, it is worth searching the internet for posts on similar scams. We try to keep cottage owners updated with current scams such as the Overpayment Scam and the Phishing Scam.

Fraudsters are always finding new ways of conning innocent people out of money and vishing scams are highly plausible and a big threat across many industries as this similar case proves involving a hairdresser.

If you have any details of similar scams you could share with holiday home owners, please leave your comments below.

I am sorry for the other home owner but I am just relieved that I am not the only one. I felt so stupid!!!!!

I have had several of these calls. The first time was very frightening as they kept ringing back every half hour or so throughout the day to check that I was doing as they asked having convinced me that I owed money. I delayed them by saying I had to get copies of my accounts to check out any missed payments. The calls became increasingly aggressive to the point of accusing me of being a liar when I assured them I did not owe any money. At that point I slammed the phone down and never heard another word. It was a deeply disturbing & upsetting episode.

I have had other calls purporting to be from debt collecting agencies and the courts. I just put the phone down immediately.

Almost every time the caller has had a Scottish accent and has called himself Mr. Laurence or Martin Jones.

Do not engage these people in conversation as they will twist everything you say to their advantage and fluster you and make you unsure of your facts to the point that you begin to believe that money is owed somewhere.

Thank you Independent Cottages for bringing this issue to everyone’s attention and I hope that no-one else is conned by these unscrupulous fraudsters.

Can I share this link please?

More than happy for you to share and let others know.

This happened to me about five months ago. Somehow they had got my work address and said that the Bailiffs were on the way to my Office to collect the money owed re an Advertisement that I had allegedly taken out but never paid for. They had my correct Office address too so must have done some research. Something didn’t seem right though and the chap got more and more aggressive as the call went on, and in the end said that he had now decided to come down to my Office and see me directly himself! I said I looked forward to his visit and slammed the phone down. Never heard anything else……..